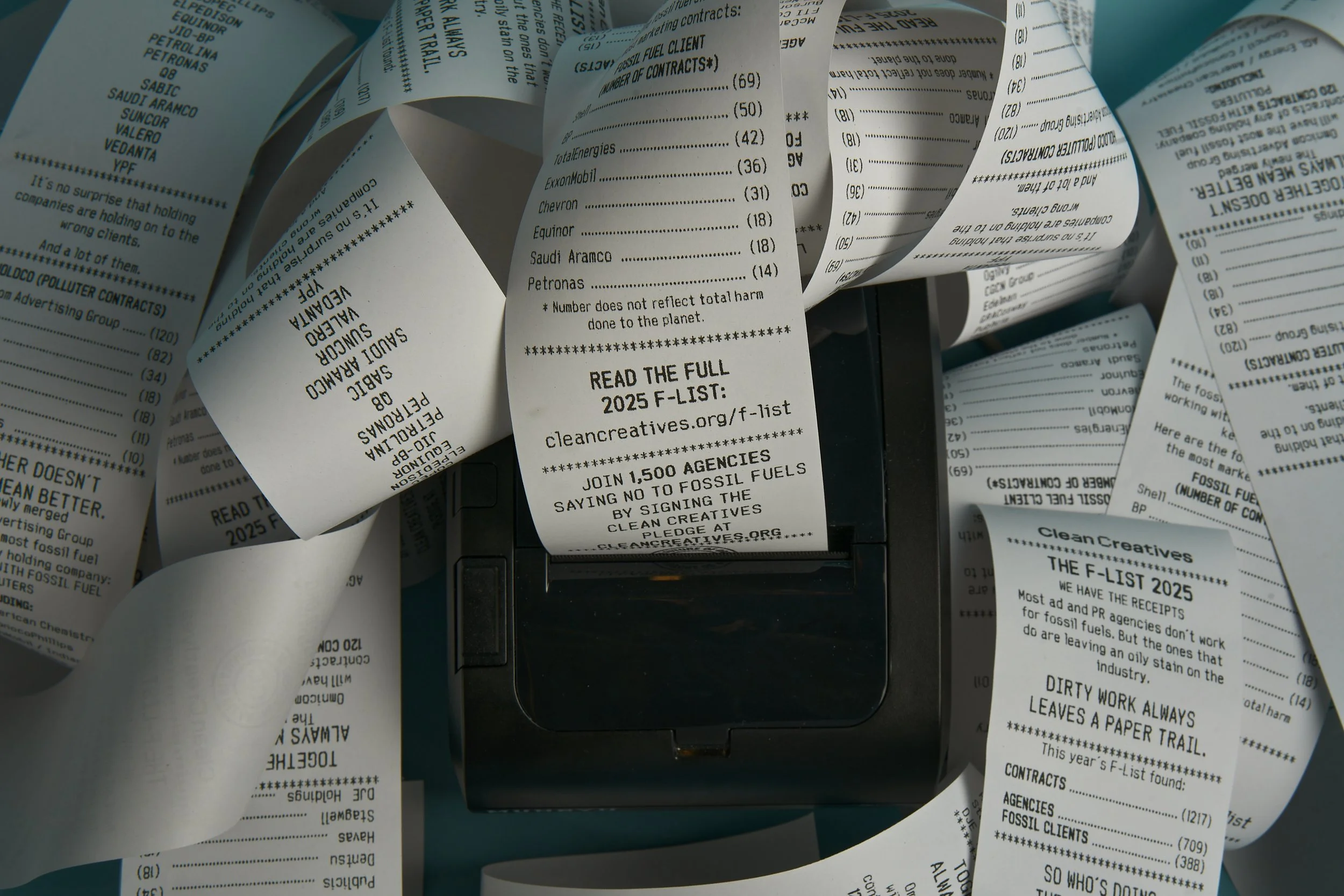

The F-List 2025

We have the receipts.

The world’s biggest ad agencies are still working for fossil fuel clients — just quietly.

For years, agencies have defended their oil and gas campaigns by saying they’re helping companies transition to renewables, but the evidence speaks for itself: oil and gas majors have been going all in on fossil fuels.

However, the rest of the world is switching to clean energy. The International Energy Agency (IEA) has reported that “clean energy technologies [are] attracting twice as much capital as fossil fuels.” Clean energy investment is set to reach a record $2.2 trillion in 2025.

The advertising industry is stuck in the past while the planet foots the bill.

Agencies understand the reputational and legal cost of fossil fuel campaigns well enough to cover up their tracks, but we have the receipts. It’s time for agencies to pay up.

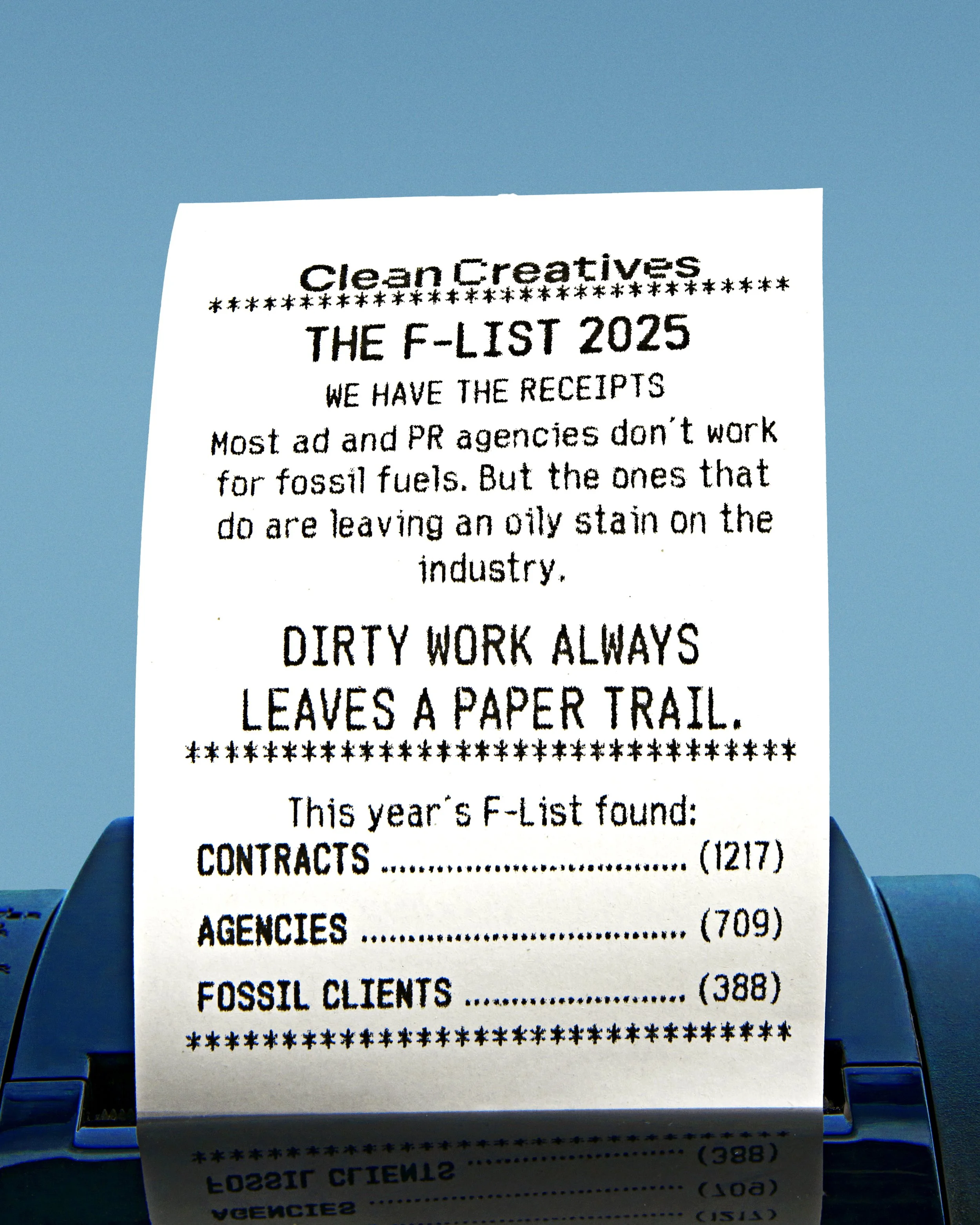

The 2025 F-List shares 1217 fossil fuel contracts held by 709 advertising and PR agencies in 2024 and 2025.

Writer and Head of Research: Nayantara Dutta

Researchers: Nayantara Dutta and Leah Siegel

With contributions from Comms Declare

Why we publish the F-List:

The F-List is the largest public database that documents relationships between advertising and PR agencies and their fossil fuel clients. It gives the creative industry the facts to decide where they stand and who they are working for.

It has led to transparency and accountability in the industry, with four Havas agencies being stripped of their B Corp certification in 2024 after Havas won Shell’s global media contract. The F-List is currently in its 5th year of publication and we have found more contracts than ever before.

In 2022, an ex-Edelman employee told the Guardian “There’s no straightforward database for employees to check exactly which clients their firms serve,” but now, creatives and brands can search and filter through the F-List to understand whether their agency is working with fossil fuel clients, and use our database of Clean Creatives-certified agencies to find their next job or agency to hire.

Currently, over 1,500 agencies and 3,700 creatives worldwide have signed the Clean Creatives pledge to decline future work with fossil fuel clients. The tides are changing. Despite the large number of agencies who work with polluters, even more have chosen to create clean.

2025 Methodology

The 2025 F-List includes all contracts that Clean Creatives found between agencies and fossil fuel companies globally in 2024 and 2025. If the contract is marked with an asterisk *, we have evidence that it has ended. However, we have included every contract which has been active at some point in these two years.

This year, our research process built on our past database by focusing on close analysis of fossil fuel contracts in Sub-Saharan Africa, Central Asia, East Asia and MENAT. We also looked into trade groups and brand studios within large publishing companies, and used our five years of data to conduct longitudinal analysis to understand patterns over time.

Our research is based entirely on public records, which include lobbying databases, government filings, LinkedIn ads, award show databases, creative portfolios and social media posts. While we believe this provides concrete proof of a contract, it means that our database is not exhaustive. Other contracts may be held at an agency that have not been shared externally. Contracts are sorted by region, and we categorize a contract as “Global” if we find evidence in at least 2 regions.

We welcome updates from any agencies who have ended their fossil fuel contracts. In most cases, we require multiple sources to verify a F-List contract, and can provide sources upon request.

With the 2025 F-List, Clean Creatives is also launching the first-ever edition of the Fossil Fuel Income Risk Exposure (FFIRE) index, which measures major agencies’ financial vulnerability based on their percentage of annual revenue from Big Oil. The FFIRE index is based on figures from Clean Creatives’ Off Ramp report, which presents a roadmap for agencies to reduce reliance on fossil fuel revenue.

We consider an agency to be any advertising or PR company which provides these services: full-service, creative, digital, PR, media, production, public affairs, data, market research, events, animation, motion design, events, OOH, sponsorship & sports, trade groups and brand studios within large publishing companies. We do not include certain types of agencies and marketing work on the F-List: recruitment, packaging design, post production, casting and internal communications as they do not directly work on public influence fossil fuel campaigns.

We consider a fossil fuel company to be any company with over 50% of revenue or generation from fossil fuels. This includes these categories: oil major, majority fossil fuel utility, gas utility, petrol distributor, oil and gas production, midstream oil and gas, LNG company, LPG company, coal production, oil and gas services, refinery company, lobbying group and some exceptions which are primarily in the business of fossil fuels (petrochemicals, oil and gas trading and oil and gas conferences). You can find a list of all the clients which meet our definition in our fossil client database.

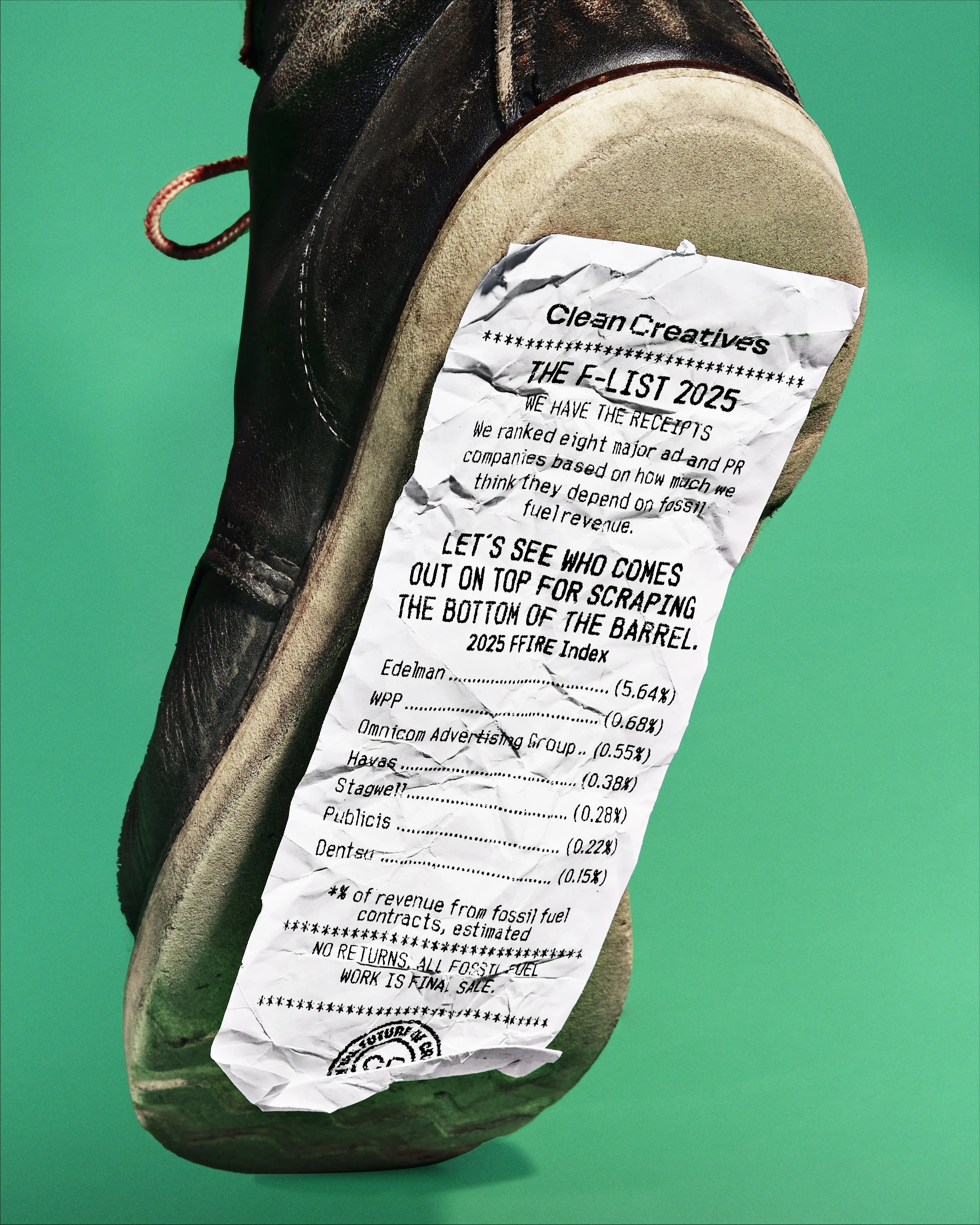

The Fossil Fuel Income Risk Exposure (FFIRE) index measures major agencies’ financial reliance on fossil fuel contracts.

The FFIRE index methodology takes the likely global advertising and PR spend of 29 major fossil fuel companies across the globe and uses the F-List to estimate which agencies are earning commissions from each client, with specific revenue calculations for media, PR, and creative contracts depending on the kind of agency involved. This revenue from fossil fuels is then compared to the holding company’s reported public revenue and reported here as a percentage.

While Omnicom, with its new merger with rival IPG, will have the highest number of fossil fuel contracts, Edelman has the highest FFIRE score, showcasing its unique vulnerability to a shift away from fossil fuels. Edelman’s score is the result of its Agency of Record relationship with Shell, as well as its longstanding relationships with polluters like Chevron and ADNOC, which are highly exposed to the clean energy transition.

Percentage revenue from fossil fuel contracts, estimated:

Edelman - 5.64%

WPP - 0.68%

Omnicom Advertising Group - 0.55%

Havas - 0.38%

Stagwell - 0.28%

Publicis - 0.22%

Dentsu - 0.15%

Edelman’s COP conflict of interest:

Edelman has been selected to lead communications for the COP30 UN Climate Talks in Brazil in November 2025, while simultaneously generating more of their revenue from fossil fuels than any other lead agency. What’s worse, the lead on their Shell account in Brazil is also working for the UN Climate Talks.

If Edelman’s fossil fuel contracts seem to be a conflict of interest, it’s because they are. The goal of the UN Climate Talks should be to reduce fossil fuel consumption, but Edelman CEO Richard Edelman has staked his business on increasing fossil fuel consumption.

And that means his company cannot provide objective advice where it’s needed most. There is literally no agency worse suited for a role at COP30. If the UN climate talks succeed in their goal, Edelman faces an existential threat to their revenue.

Dentsu:

Over the years, Dentsu has been more transparent than other networks about their sustainability goals and progress. In 2021, Dentsu regularly reported on its net zero action plan and has been making incremental strides towards their GHG emissions goal, although progress has not been linear, as their carbon emissions increased between 2022 and 2023. However, their number of fossil fuel clients has stayed the same between the 2024 and 2025 F-List.

They may be reviewing business travel and suppliers, but continue to work with Shell, Petronas, OMV and Chevron. Considering how much attention Dentsu has paid to its internal standards, it says a lot that they have done nothing about their fossil fuel clients.

Currently, Dentsu is pursuing a sale, and made extensive job cuts in preparation. We encourage Dentsu to approach this transition with the goal of aligning their company for the future, without the negative associations of fossil fuel clients.

Edelman (DJE Holdings)

Edelman maintains the most extensive fossil fuel legacy of any agency, taking every measure to evade the truth and deceive the public about climate change. However, if you ask Richard Edelman, one of “America’s top climate villains,” he believes his work at COP28 “resulted in the landmark UAE Consensus to transition away from fossil fuels” - when in reality, their client ADNOC used the talks to make $100 billion in new oil sales. Ironically, the firm that releases the annual Trust Barometer is the one you cannot trust to tell you the truth.

Edelman’s two decades of work for petrostates and oil majors constantly contradicts their climate principles to “work with those committed to accelerating action to Net Zero and in compliance with the Paris Accords,” “put science and facts first” and “advance best practices and standards for climate communications.”

Although Edelman has 10 contracts on the 2025 F-List, it has the highest score on Clean Creatives’ Fossil Fuel Income Risk Exposure (FFIRE) index, with an estimated 12% of revenue from fossil fuels. Edelman has recently been hired to work on COP30 in Brazil, despite working for a trade group linked to deforestation in the Amazon, as well as the fossil fuel companies most responsible for climate change.

In 2024, Clean Creatives found exclusive evidence that Edelman had been working with Chevron, Sasol and ConocoPhillips and this year, we are breaking news of two Edelman contracts with Aksa Enerji and LNG Canada.

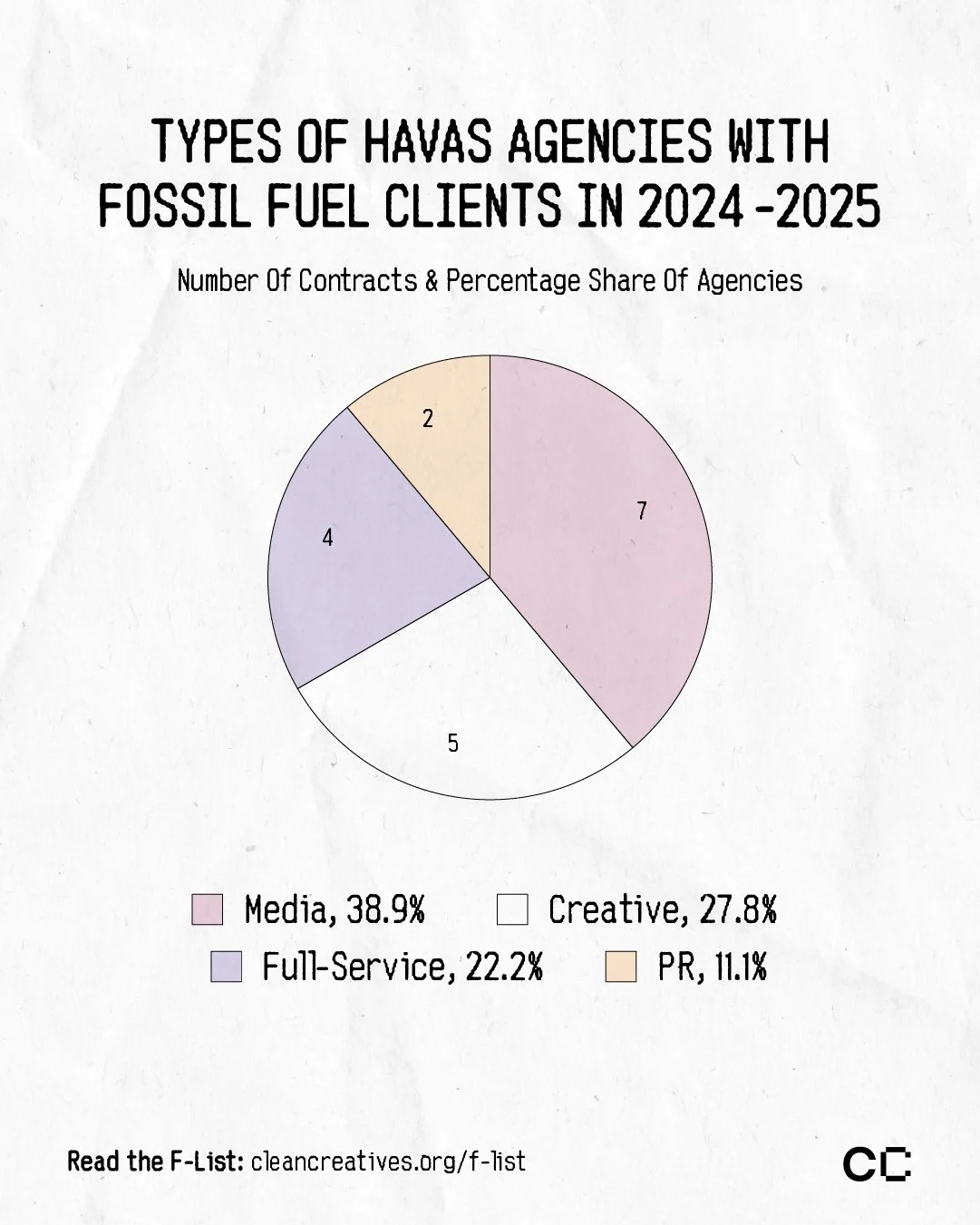

Havas

Havas used to be an agency with the potential for change, but has gone all in on fossil fuels, which is not entirely surprising given its CEO Yannick Bolloré’s family empire, the Bolloré Group, owns 30.4% of Havas and also invests in pipelines and oil storage.

In 2023, Havas won Shell’s global media business and paid the price, with four Havas agencies losing their B Corp certification in 2024 in response to a complaint filed by Clean Creatives and 22 B Corp agencies. We calculate that this decision ended up in a potential $100 million loss for the company based on staff retention, lost contracts, and sunk costs of lost certifications.

Since then, although Havas knows they “experienced significant negative publicity and corresponding reputational harm” from losing their B Corp status, they still continue to work with Shell, TotalEnergies and Repsol.

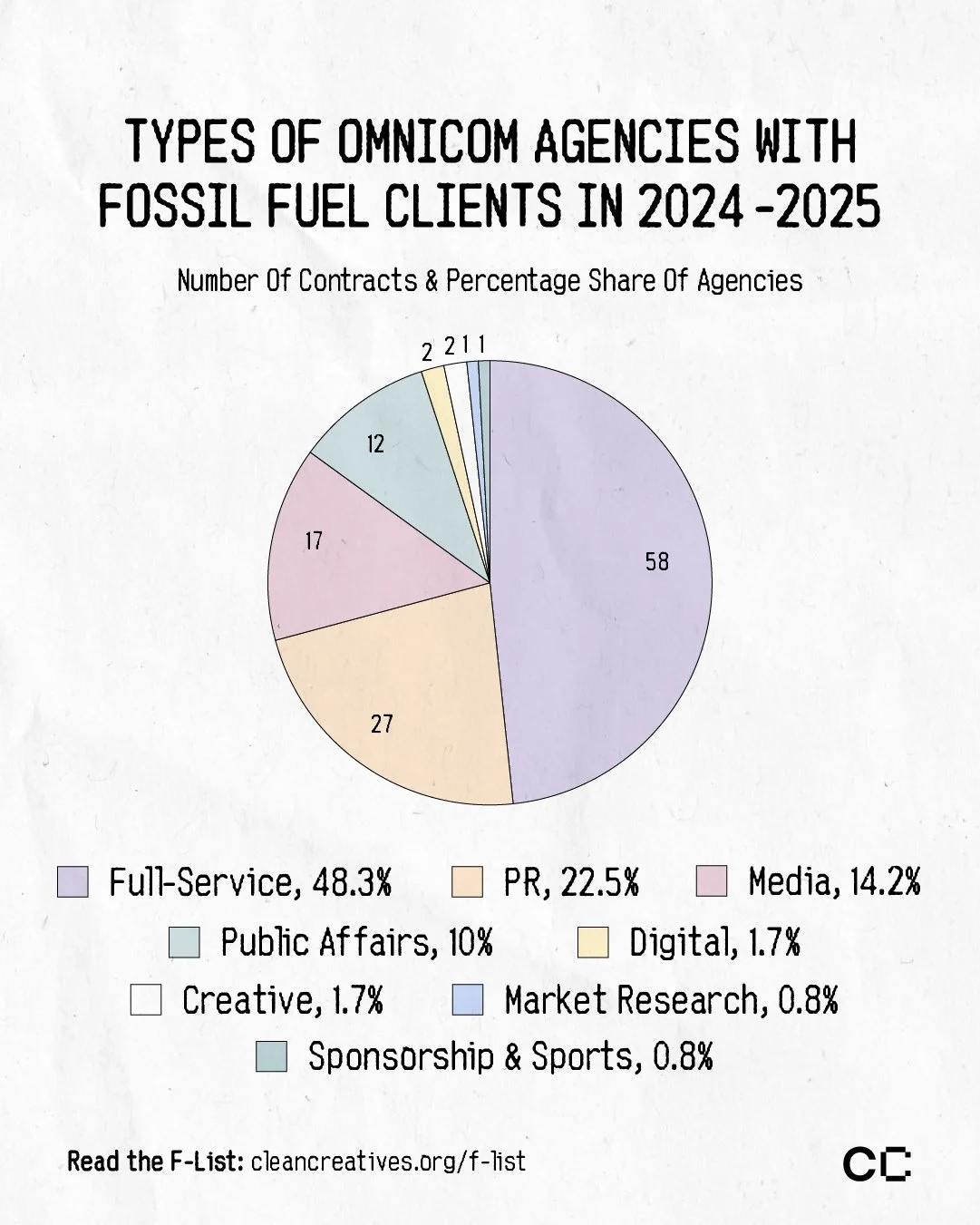

Omnicom Advertising Group

In December 2024, the merger of Omnicom and Interpublic Group (IPG) shook the industry and created the world’s largest holding company and F-List network. As a result of the merger, Omnicom has surpassed WPP for the first time ever with the most contracts on the F-List, moving from 74 contracts on the 2024 F-List to 120 contracts this year, making up 10% of the overall list.

When it comes to climate, Omnicom has historically kept quiet and let its work do the talking. Their last sustainability update was from 2023, where they shared that they use 35% renewable energy on the tiny Corporate Responsibility section of their website. On the other end, IPG has made false promises to screen prospective oil and gas clients to make sure they follow the Paris Agreement, but we have found 6 new contracts on the 2025 F-List between IPG and clients including Saudi Aramco, Shell, Jio-BP and Vedanta.

Overall, the new Omnicom Advertising Group has quietly been collecting cards and currently has a full deck as the only network on the F-List to have contracts with all 10 oil and gas majors.

Publicis

Publicis has a lot to say about climate, except when the rules apply to them. Since 2017, Publicis has used an AI carbon calculator called A.L.I.C.E to reduce emissions by estimating how much energy, travel, paper and waste will be used in a client campaign. It’s a nice thought, but measuring internal emissions is a drop in the ocean compared to the advertised emissions generated by Publicis’ work for global carbon polluters including Saudi Aramco, Chevron, TotalEnergies and ADNOC.

In 2009, Publicis Groupe banned greenwashing and any other marketing activity to mislead customers, but its subsidiary Carré Noir is responsible for rebranding Total as TotalEnergies to indicate a transition to renewables, while fossil fuels are 97% of their 2024 energy production. In the past few years, they have also created a unit called One Energy dedicated to working for Saudi Aramco, the world’s largest corporate polluter. If Publicis truly believed “the fight against climate change is a priority,” they wouldn’t be working with Big Oil.

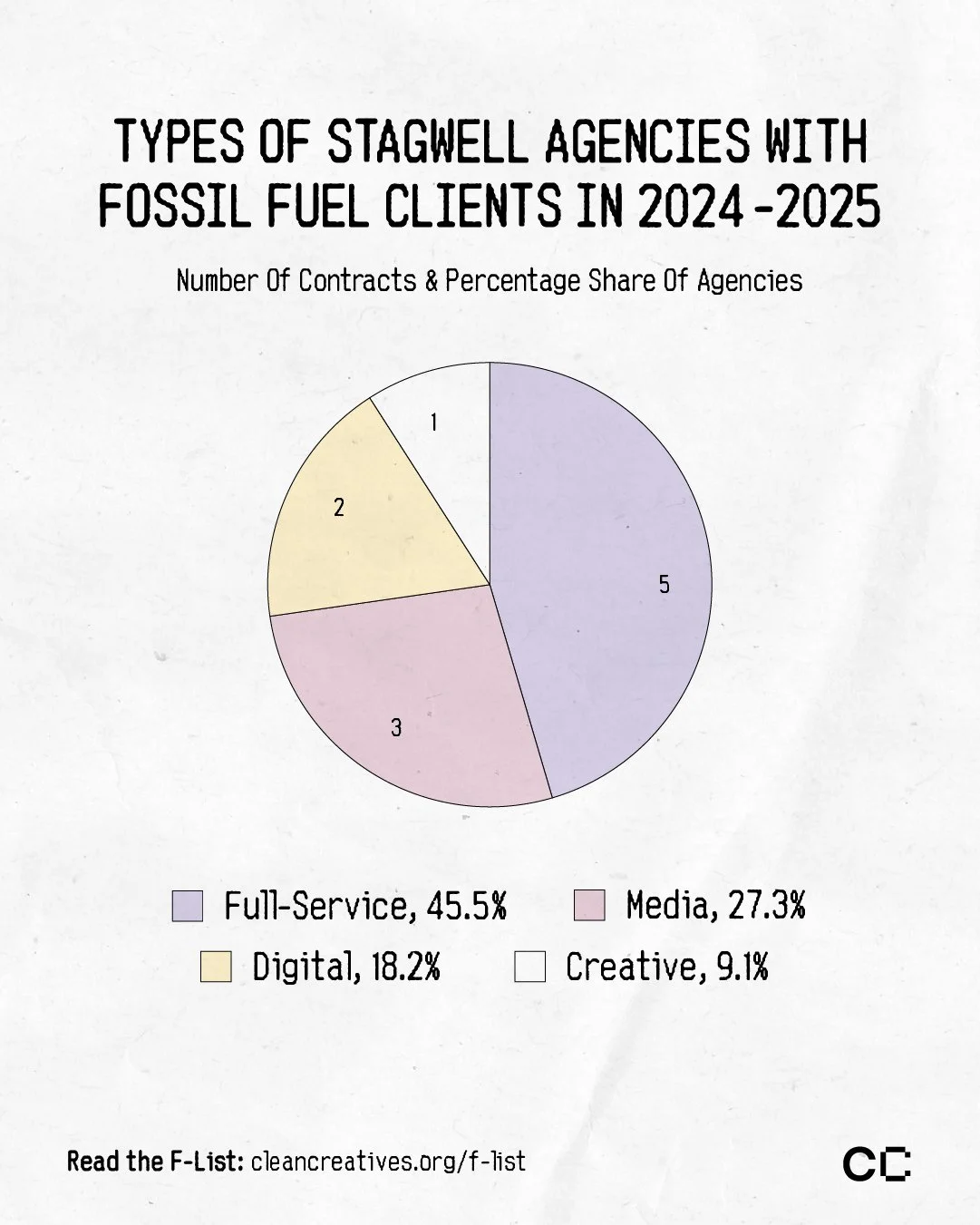

Stagwell

Last year, Stagwell was the holding company with the least number of contracts (7) on the F-List but, due to new agency acquisitions, has now slightly surpassed Edelman with 11 contracts.

Stagwell does not mention a climate policy or sustainability commitments in its 2024 annual report. Although several Stagwell agencies have signed the Clean Creatives pledge to say no to fossil fuel clients, Stagwell is the only holding company to have zero discontinued contracts between the 2024 and 2025 editions of the F-List, showing continued work for fossil fuel clients. There is a huge opportunity for Stagwell to take a stand for the climate, if they would be more discerning with choosing new affiliates.

WPP

WPP hasn’t been having the best year. In February 2025, WPP received the world’s first OCED complaint against an ad agency for its work for 79 fossil fuel polluters, as shown by the 2024 F-List. In July 2025, WPP shares reached a 16-year low and, one month later, WPP profits dropped by 71% due to clients’ cuts in ad spending and Mark Read announced he would be stepping down as CEO.

For years, WPP has been the world’s largest holding network with fossil fuel contracts that date back to 1929, but has recently been overtaken by Omnicom Advertising Group (OAG). Still, they show no signs of letting go of their oil clients, moving from 79 to 82 contracts between the 2024 and 2025 F-List.

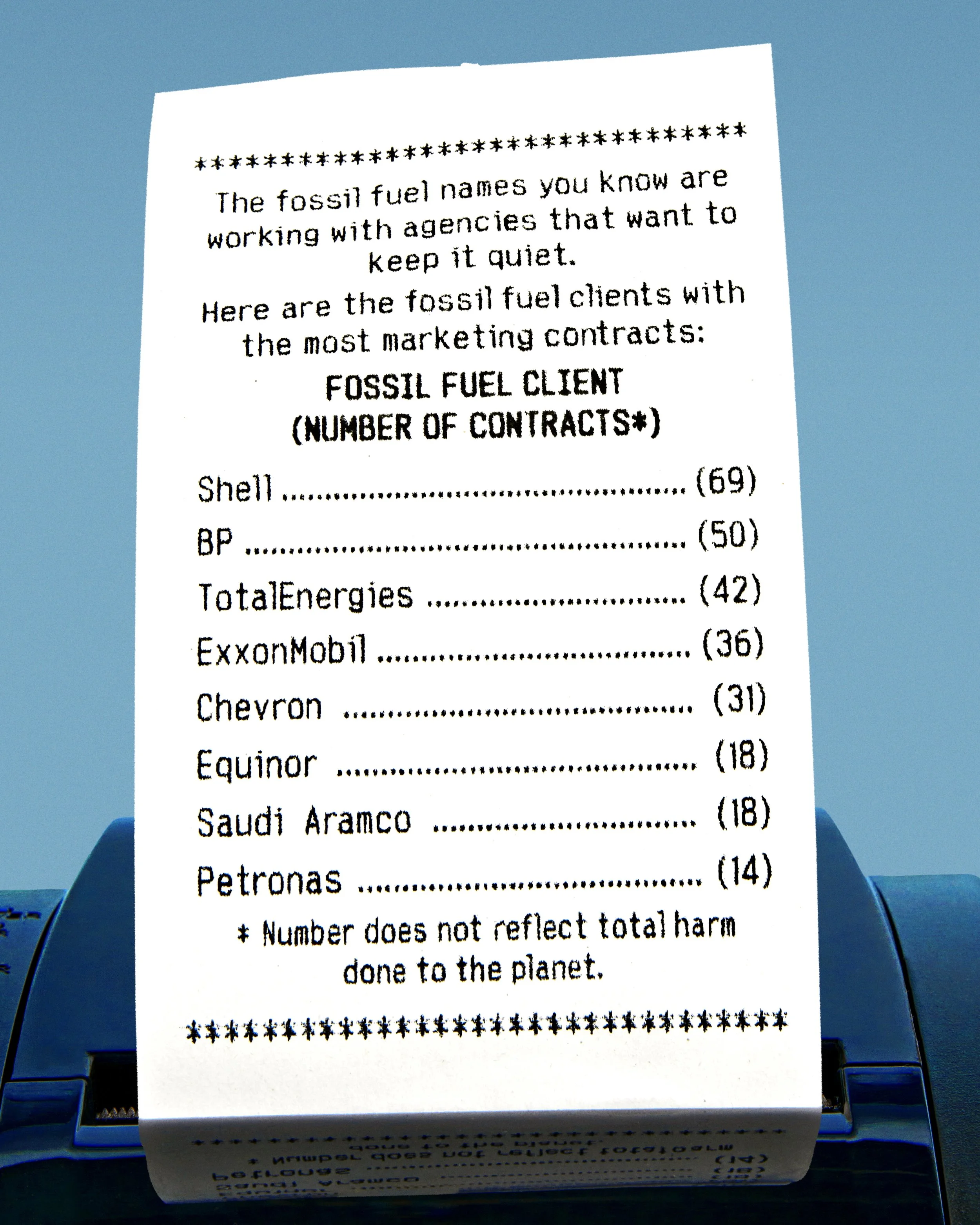

Top clients and agencies

Fossil fuel clients with the most contracts:

Shell (69)

BP (50)

TotalEnergies (42)

ExxonMobil (36)

Chevron (31)

Equinor (18)

Saudi Aramco (18)

Petronas (14)

Eni (9)

Valero (5)

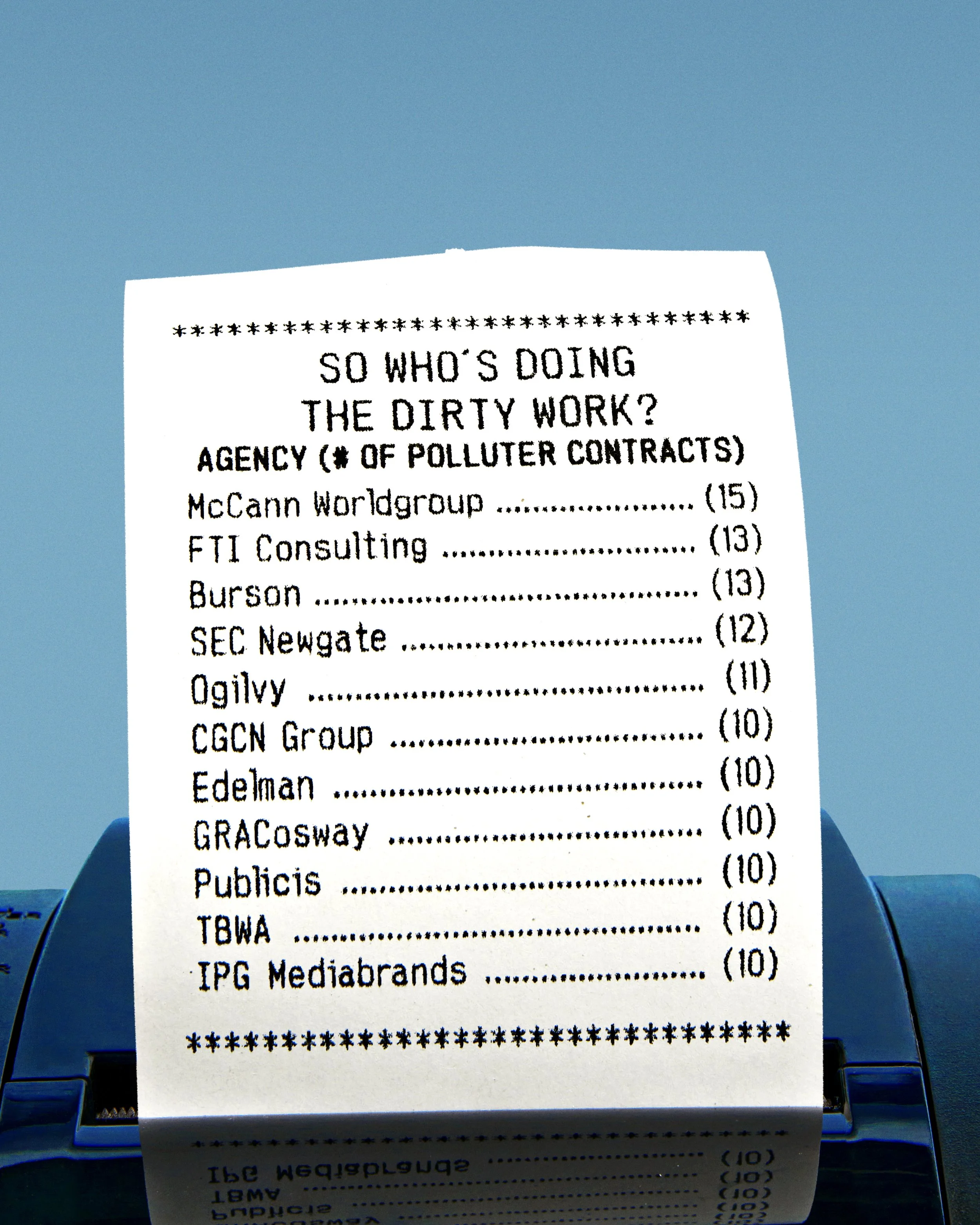

Agencies with the most fossil fuel contracts:

McCann Worldgroup (15)

FTI Consulting (13)

Burson (13)

SEC Newgate (12)

Ogilvy (11)

CGCN Group (10)

Edelman (10)

GRACosway (10)

Publicis (10)

TBWA (10)

IPG Mediabrands (10)

Fossil client database

With the F-List, we have also launched a database of over 400 fossil fuel clients with over 50% revenue or generation from fossil fuels. You can filter by country and industry to know more about each company on the F-List.

Clean Creatives agencies

Fortunately, a majority of agencies don’t work with fossil fuels. Over 1500 agencies have made it official by signing the Clean Creatives pledge. See which agencies say no to contracts with fossil fuel companies, trade associations, or front groups here.