Profitable Growth Without Fossil Fuels

Fossil fuel marketing makes up less than 1% of global marketing spend. Here is how agencies can protect their climate-vulnerable clients, replace the revenue from fossil fuels, and build a stronger future.

The planet is changing.

The economy is changing.

It’s time for the marketing industry to change, too.

This report presents a roadmap for agencies in the marketing industry to reduce reliance on fossil fuel revenue and begin the process of gradually off-ramping fossil fuel clients, replacing these contracts with viable alternatives while ensuring profitability and minimizing disruption to the workforce.

It’s important to understand the size, scale and dynamics of the financial relationship between marketing agencies—specifically public relations, creative and media agencies—and their fossil fuel clients.

This report proposes a model to approximate an overall spend of $6.97 billion by fossil fuel companies on public relations, creative and media. This represents less than 1% of global marketing spend across all industries.

The exact figures for each fossil fuel client’s spend and each agency’s revenue from them are closely held company secrets. Consequently, financial modeling in this report is informed by public financial disclosures, industry knowledge and best practice, many off-the-record conversations and expertise from an extensive shared network.

The ambition of this report is to help future-proof industry revenue and shift the conversation about transitioning fossil fuel clients from risk to opportunity.

Change is possible.

Some agencies are more ready than others.

Here is the pathway out for each:

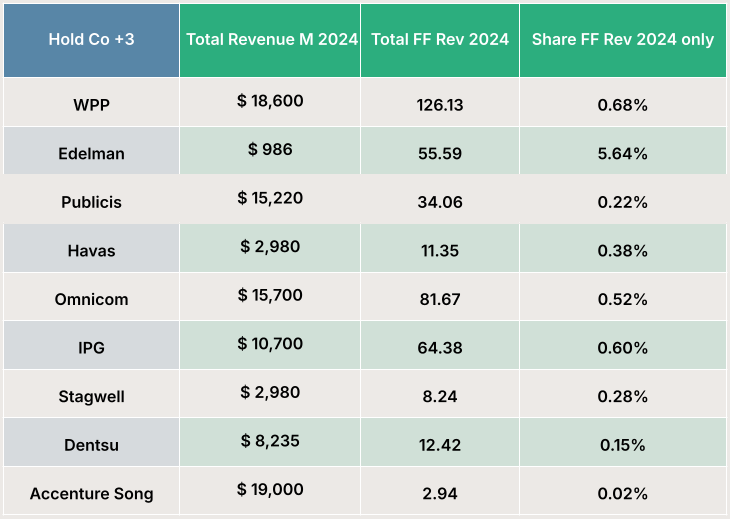

This report estimates that the top 29 oil majors spent approximately $6.97 billion in 2024 on media, creative, and PR, generating an estimated $3.03 billion in billings for the major global marketing holding companies plus Edelman, Accenture Song and Stagwell.

For most agencies, fossil fuel majors represent less than 1% of their annual revenue, with one notable exception, and conflicts of interest of varying size depending on their portfolio.

In this report, we propose pathways out of fossil fuels for the holding companies plus Edelman, Accenture Song and Stagwell, focusing on their respective strengths and top clients in climate-vulnerable sectors.